Over the last six months, Qualcomm shares have sunk to $153.85, producing a disappointing 7.7% loss - worse than the S&P 500’s 1.2% drop. This might have investors contemplating their next move.

Following the drawdown, is now an opportune time to buy QCOM? Find out in our full research report, it’s free.

Why Does Qualcomm Spark Debate?

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ:QCOM) is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

Two Things to Like:

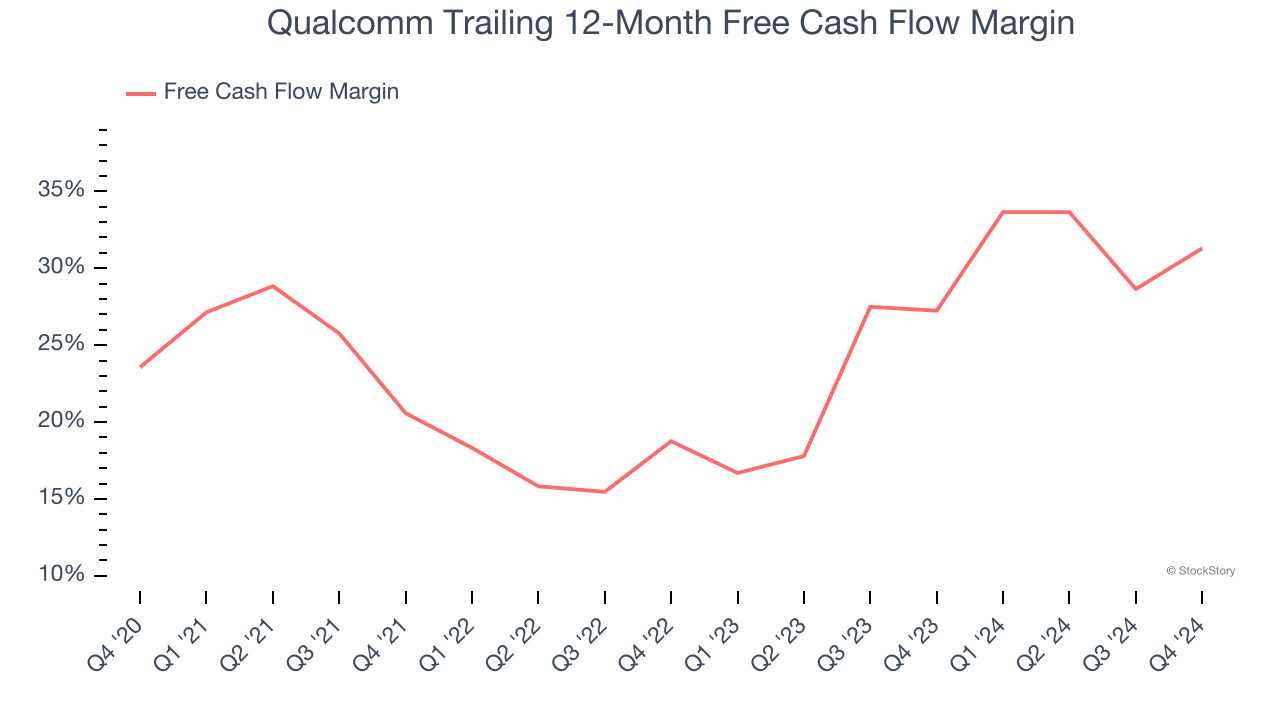

1. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Qualcomm has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging 29.4% over the last two years.

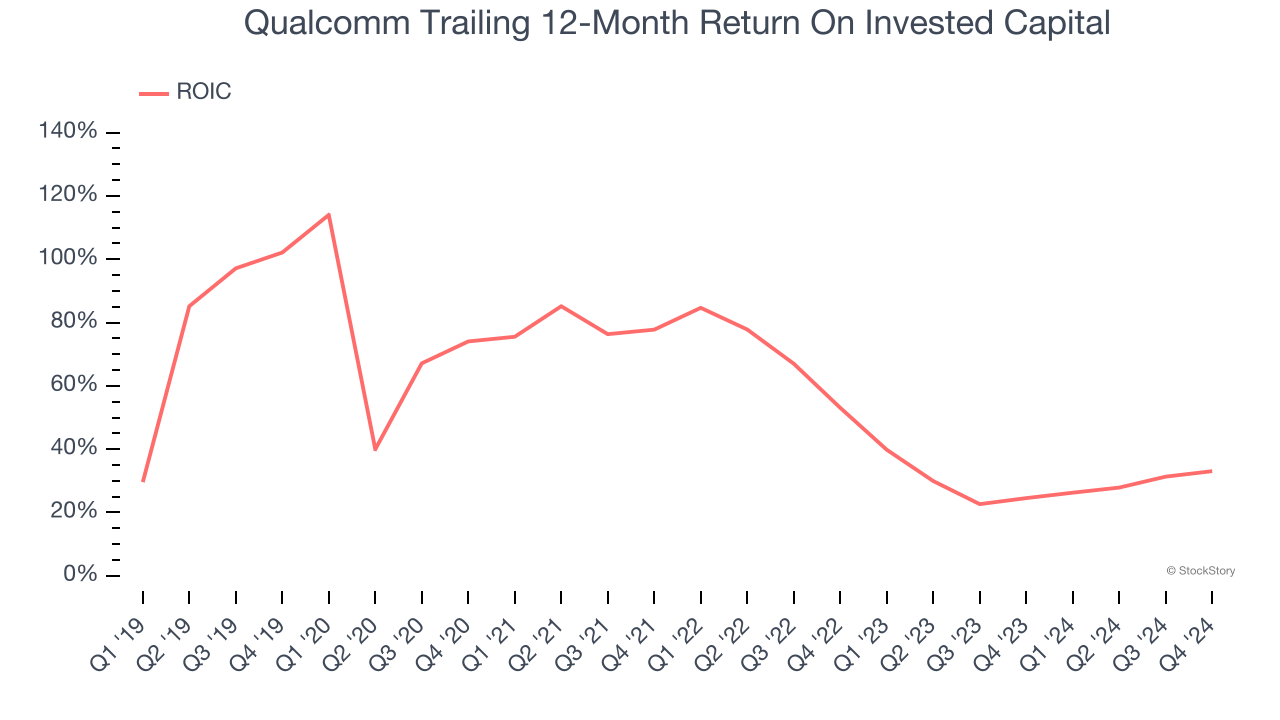

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Qualcomm’s five-year average ROIC was 52.5%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

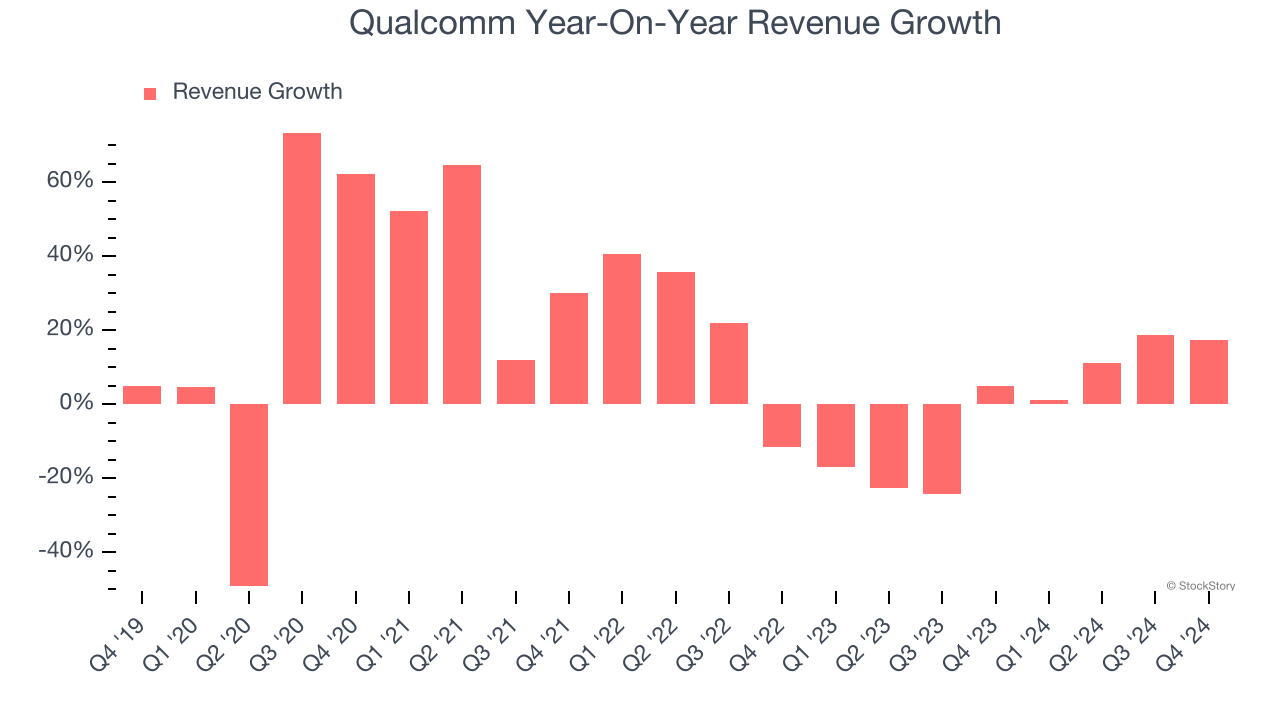

Revenue Tumbling Downwards

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Qualcomm’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.7% over the last two years.

Final Judgment

Qualcomm’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 13.1× forward price-to-earnings (or $153.85 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Qualcomm

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.