Over the past six months, Pure Storage’s shares (currently trading at $55.49) have posted a disappointing 13% loss while the S&P 500 was flat. This may have investors wondering how to approach the situation.

Following the pullback, is this a buying opportunity for PSTG? Find out in our full research report, it’s free.

Why Are We Positive On Pure Storage?

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage (NYSE:PSTG) provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

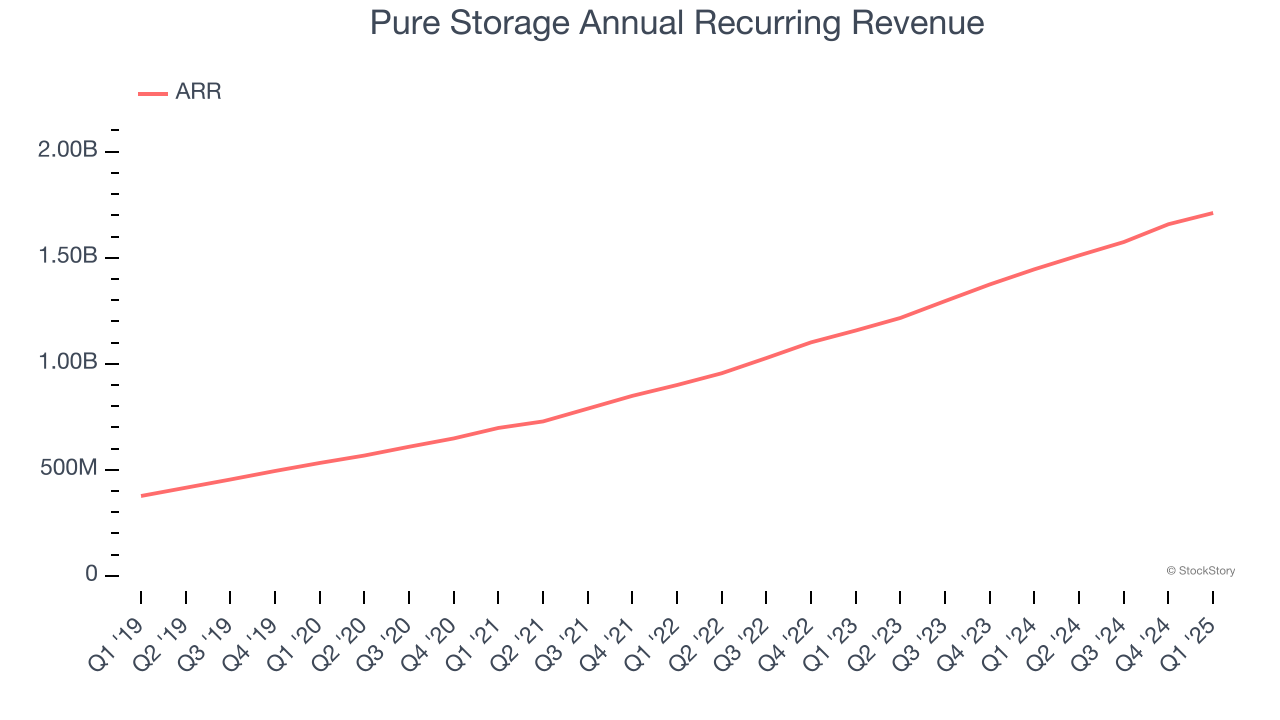

1. ARR Surges as Recurring Revenue Flows In

In addition to reported revenue, ARR (annual recurring revenue) is a useful data point for analyzing Hardware & Infrastructure companies. This metric shows how much Pure Storage expects to collect from its existing customer base in the next 12 months, giving visibility into its future revenue streams.

Pure Storage’s ARR punched in at $1.71 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 23.5%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s product offerings. Its growth also makes Pure Storage a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

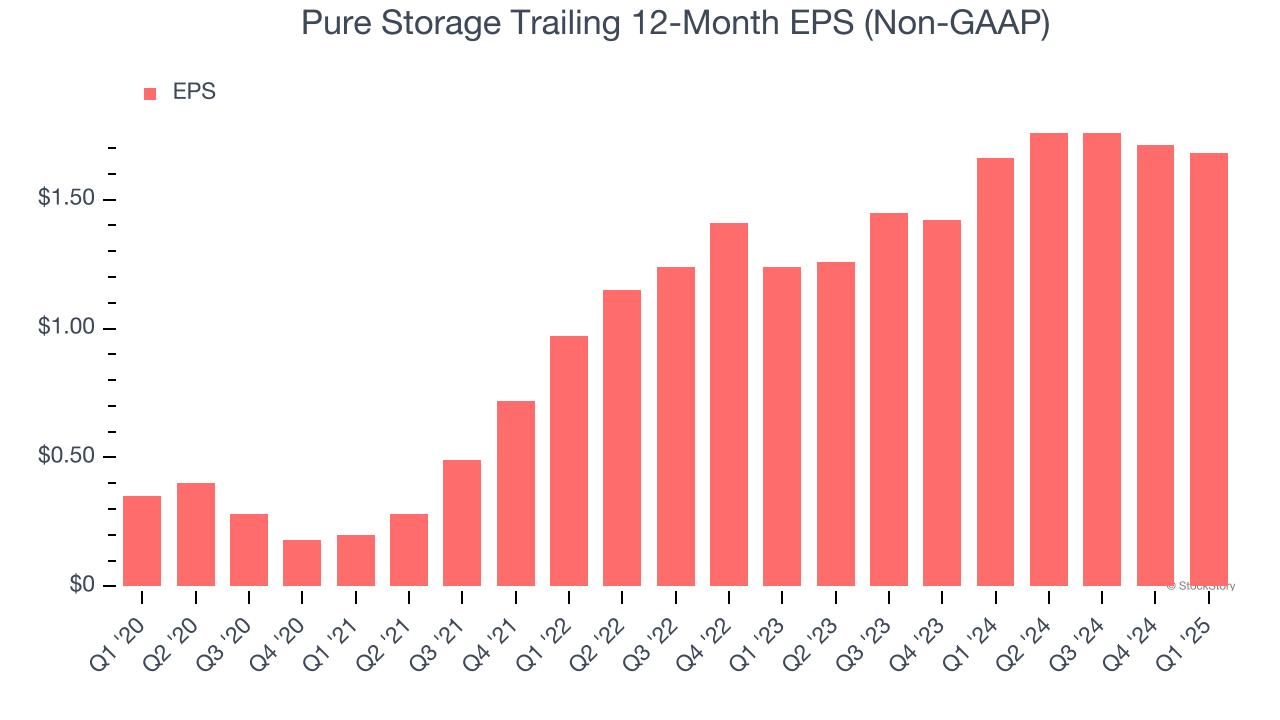

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Pure Storage’s EPS grew at an astounding 36.9% compounded annual growth rate over the last five years, higher than its 14.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

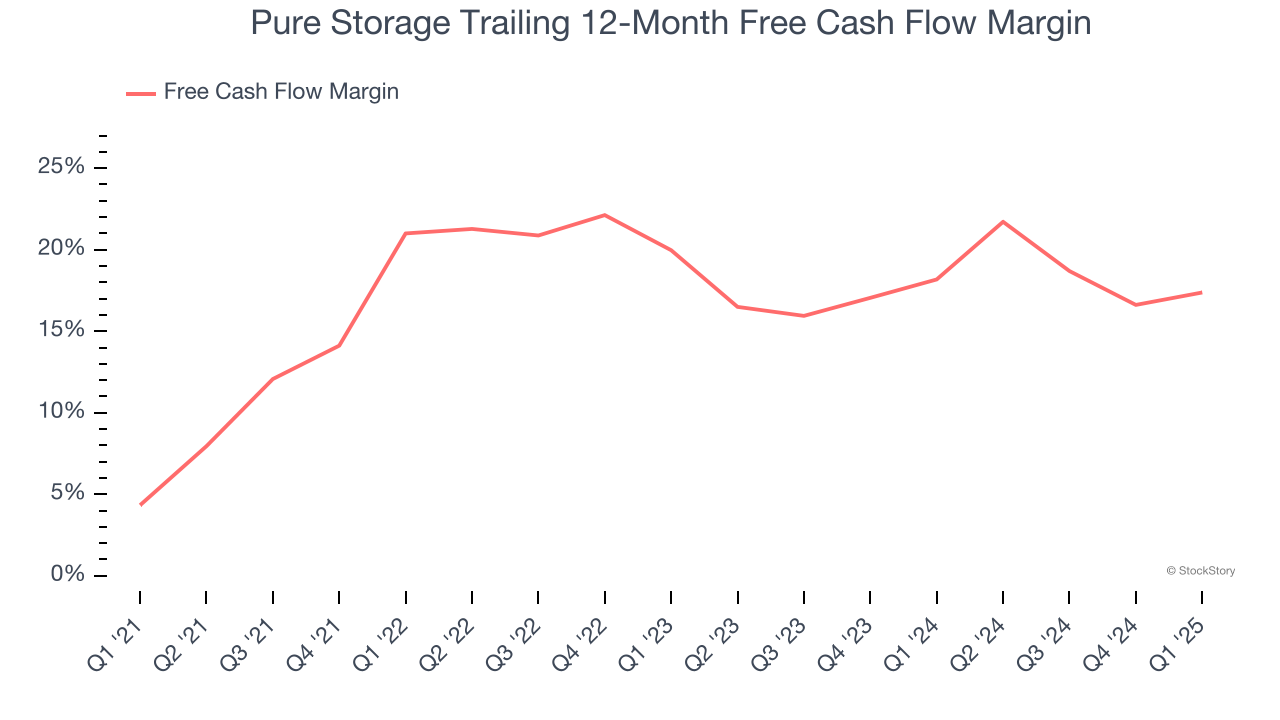

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Pure Storage has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 17% over the last five years.

Final Judgment

These are just a few reasons why we think Pure Storage is an elite business services company. After the recent drawdown, the stock trades at 30.5× forward P/E (or $55.49 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.