Hospital operator HCA Healthcare (NYSE:HCA) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 6.4% year on year to $18.61 billion. The company expects the full year’s revenue to be around $75 billion, close to analysts’ estimates. Its GAAP profit of $6.83 per share was 9.2% above analysts’ consensus estimates.

Is now the time to buy HCA Healthcare? Find out by accessing our full research report, it’s free.

HCA Healthcare (HCA) Q2 CY2025 Highlights:

- Revenue: $18.61 billion vs analyst estimates of $18.47 billion (6.4% year-on-year growth, 0.7% beat)

- EPS (GAAP): $6.83 vs analyst estimates of $6.25 (9.2% beat)

- Adjusted EBITDA: $3.85 billion vs analyst estimates of $3.71 billion (20.7% margin, 3.9% beat)

- The company slightly lifted its revenue guidance for the full year to $75 billion at the midpoint from $74.3 billion

- EBITDA guidance for the full year is $15 billion at the midpoint, above analyst estimates of $14.85 billion

- Operating Margin: 13%, down from 15.8% in the same quarter last year

- Free Cash Flow Margin: 16.3%, up from 3.9% in the same quarter last year

- Market Capitalization: $82.15 billion

“We are pleased to report strong financial results for the second quarter. They reflected solid revenue growth, improved margins, and better outcomes for our patients. I want to thank our exceptional colleagues for their great work and continuous efforts to improve,” said Sam Hazen, Chief Executive Officer of HCA Healthcare.

Company Overview

With roots dating back to 1968 and a network spanning 20 states, HCA Healthcare (NYSE:HCA) operates a network of 190 hospitals and 150+ outpatient facilities providing a full range of medical services across the US and England.

Revenue Growth

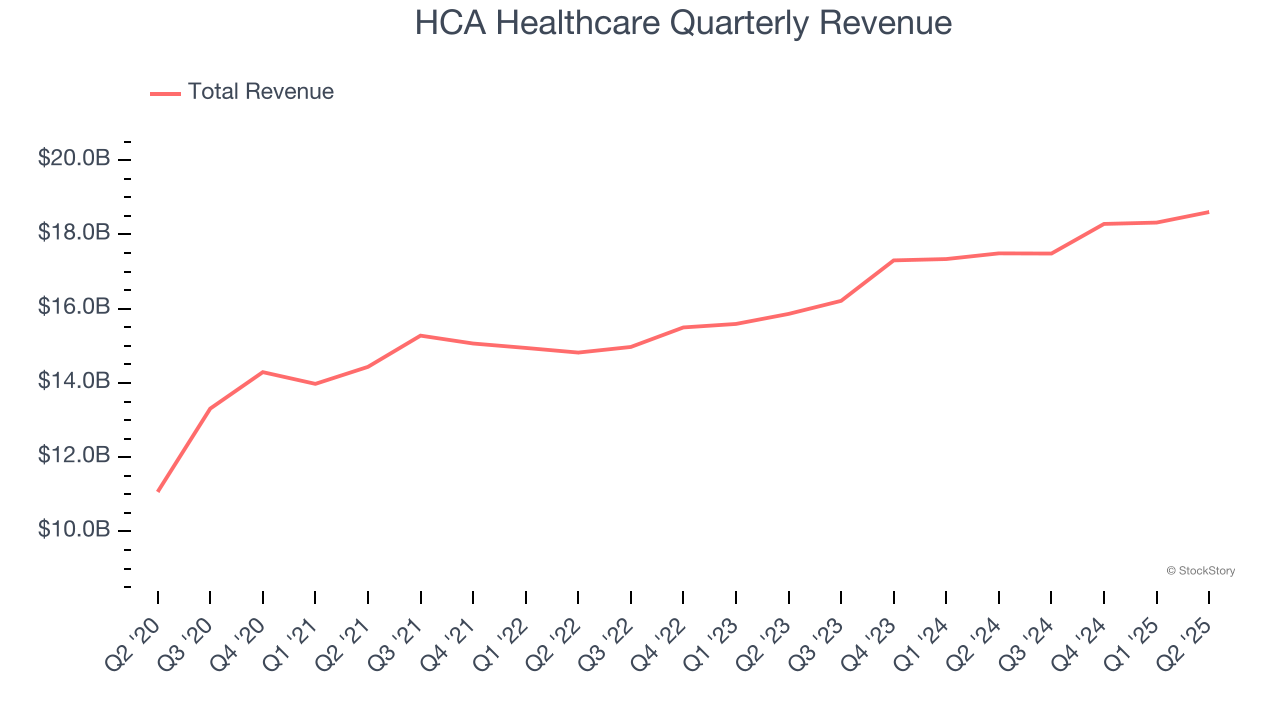

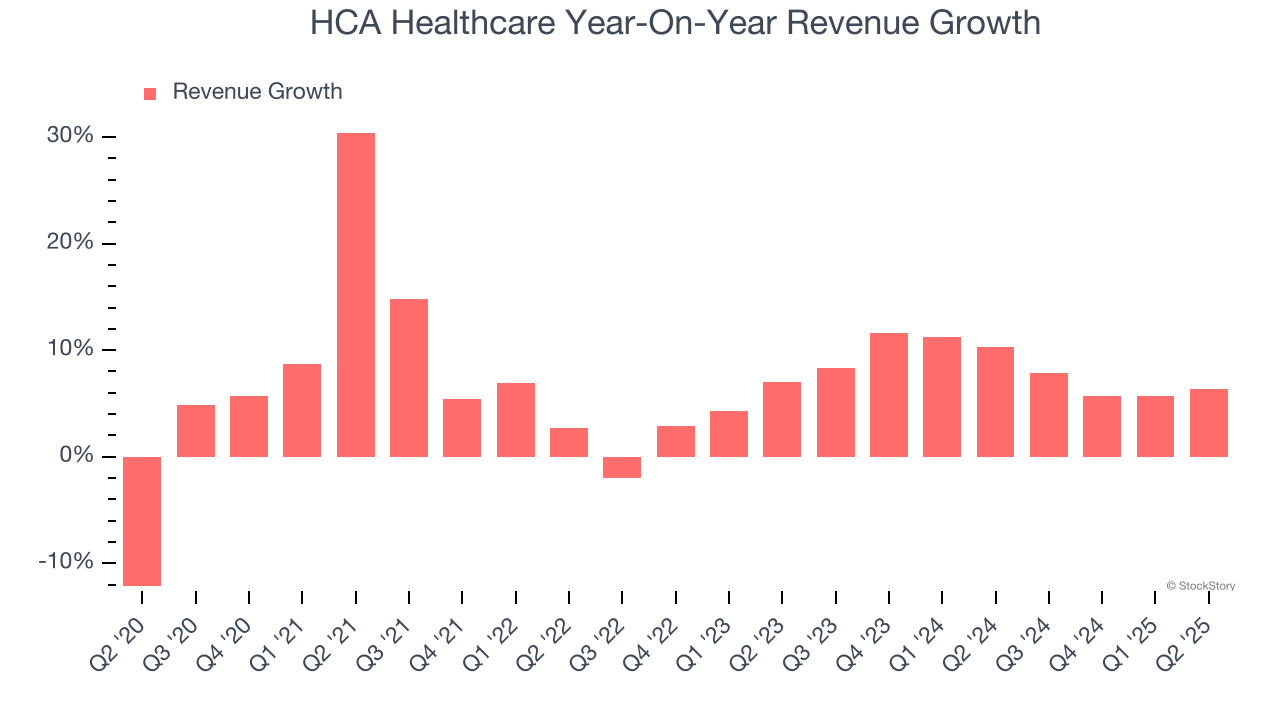

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, HCA Healthcare’s 7.7% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. HCA Healthcare’s annualized revenue growth of 8.4% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, HCA Healthcare reported year-on-year revenue growth of 6.4%, and its $18.61 billion of revenue exceeded Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and suggests the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

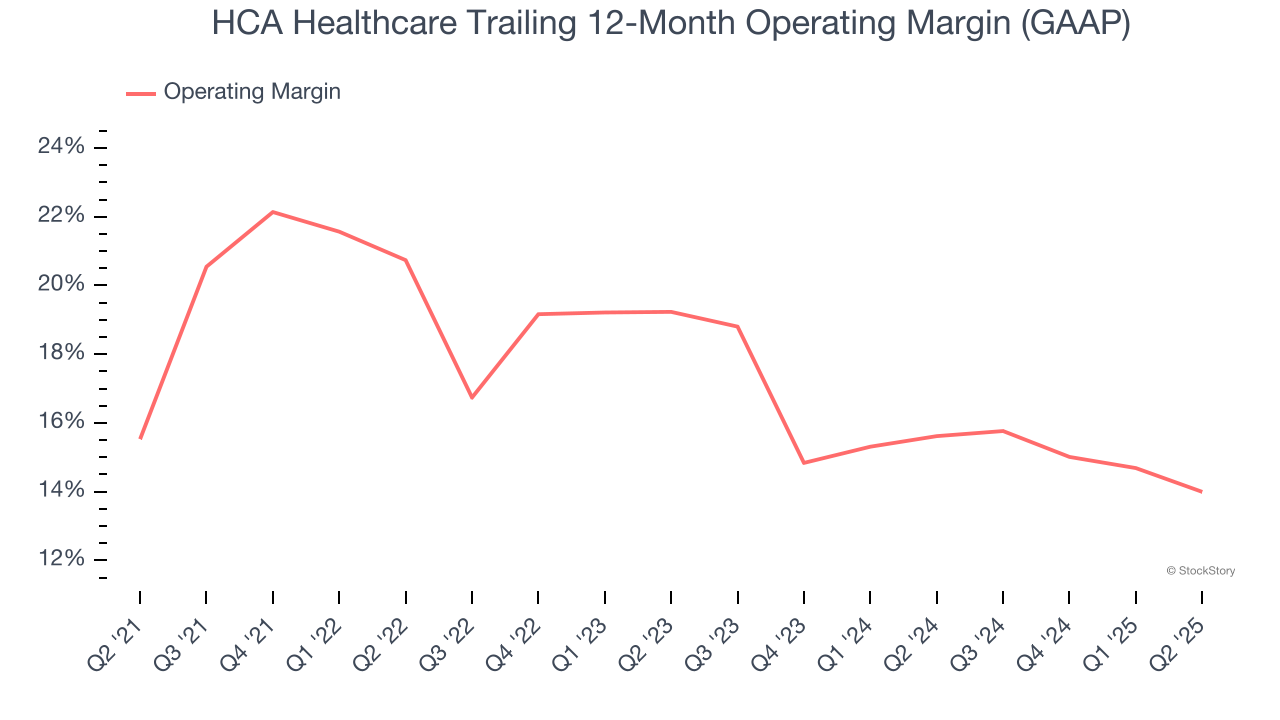

HCA Healthcare has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 16.9%.

Looking at the trend in its profitability, HCA Healthcare’s operating margin decreased by 1.5 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 5.2 percentage points on a two-year basis. We still like HCA Healthcare but would like to see it make some adjustments.

This quarter, HCA Healthcare generated an operating margin profit margin of 13%, down 2.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

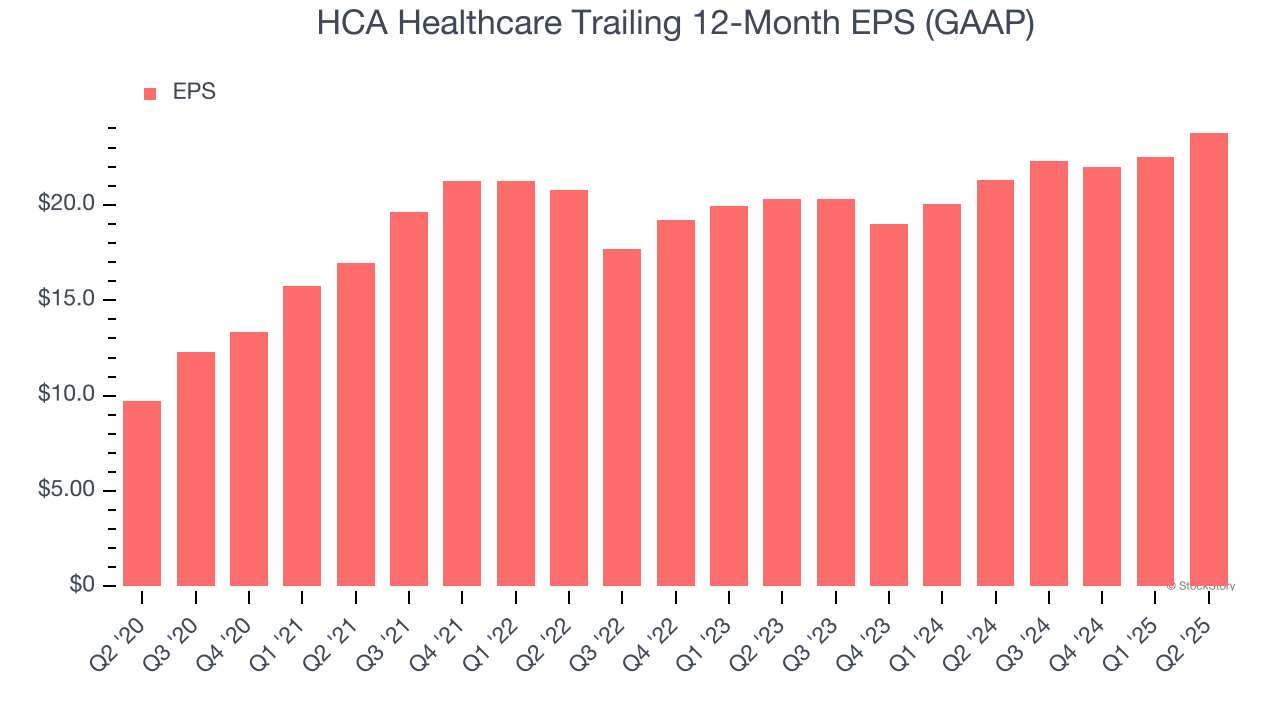

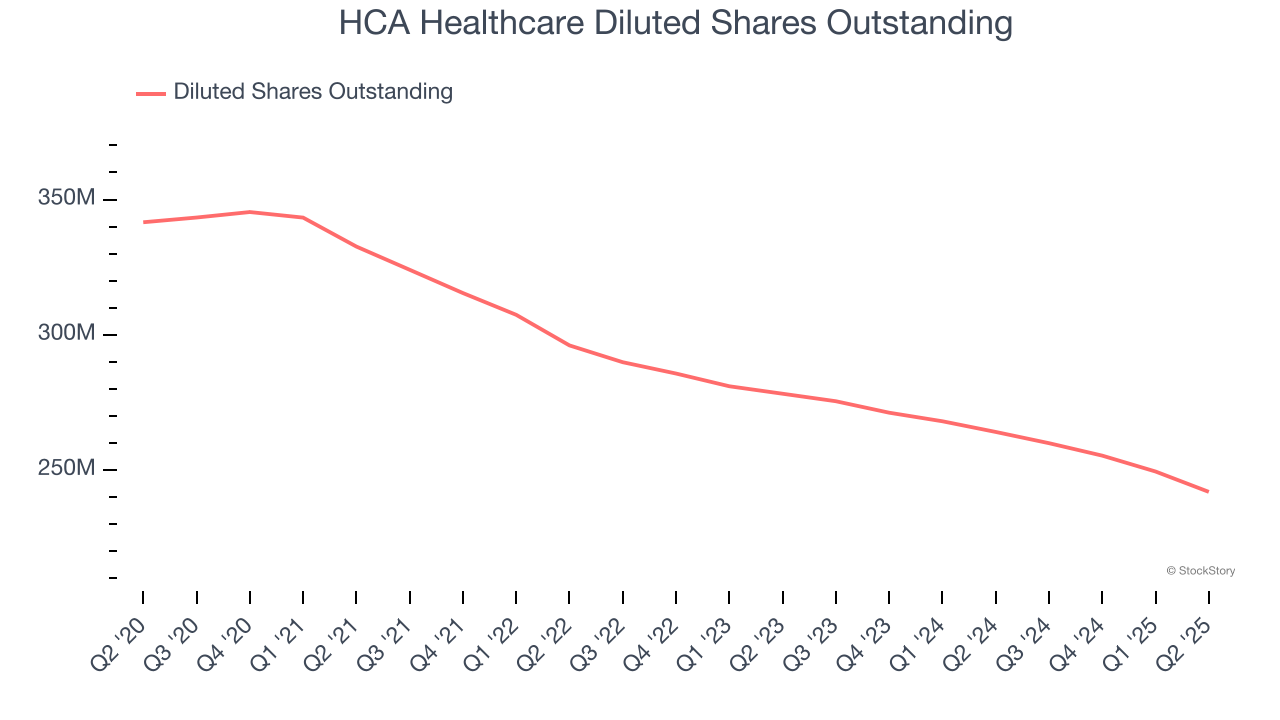

HCA Healthcare’s EPS grew at an astounding 19.7% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

We can take a deeper look into HCA Healthcare’s earnings to better understand the drivers of its performance. A five-year view shows that HCA Healthcare has repurchased its stock, shrinking its share count by 29.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q2, HCA Healthcare reported EPS at $6.83, up from $5.53 in the same quarter last year. This print beat analysts’ estimates by 9.2%. Over the next 12 months, Wall Street expects HCA Healthcare’s full-year EPS of $23.80 to grow 12.2%.

Key Takeaways from HCA Healthcare’s Q2 Results

It was encouraging to see HCA Healthcare beat analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also happy it lifted its full-year guidance. Overall, this print had some key positives. The stock traded up 1.1% to $345 immediately after reporting.

Big picture, is HCA Healthcare a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.