Over the past six months, Columbus McKinnon’s stock price fell to $14.91. Shareholders have lost 15.7% of their capital, which is disappointing considering the S&P 500 has climbed by 15.7%. This might have investors contemplating their next move.

Is there a buying opportunity in Columbus McKinnon, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Columbus McKinnon Will Underperform?

Despite the more favorable entry price, we're cautious about Columbus McKinnon. Here are three reasons why CMCO doesn't excite us and a stock we'd rather own.

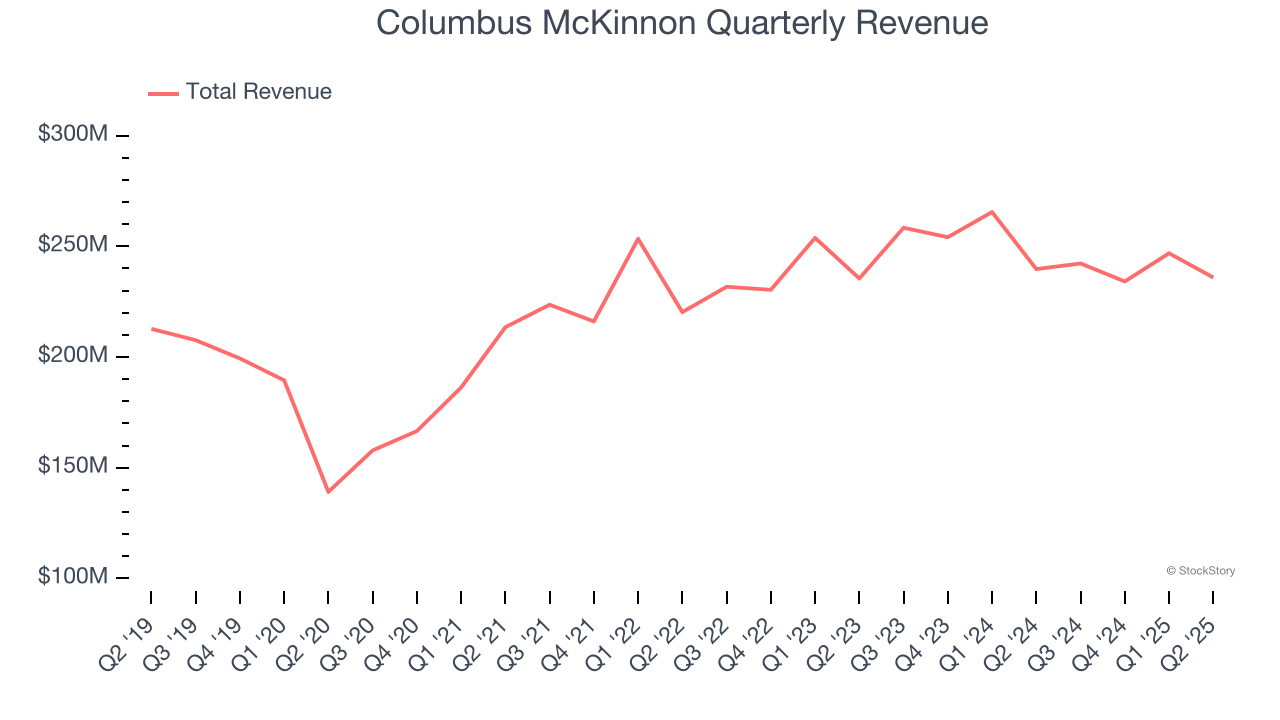

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Columbus McKinnon’s sales grew at a tepid 5.5% compounded annual growth rate over the last five years. This was below our standard for the industrials sector.

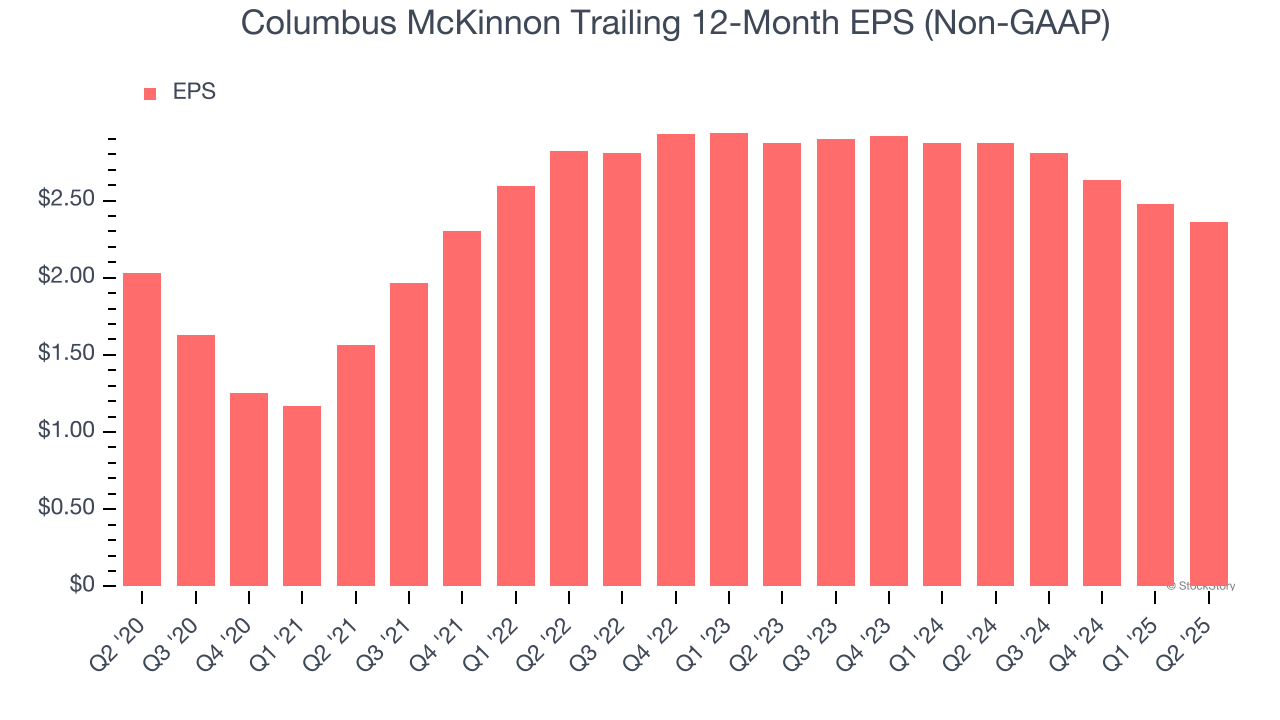

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Columbus McKinnon’s EPS grew at a weak 3.1% compounded annual growth rate over the last five years, lower than its 5.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

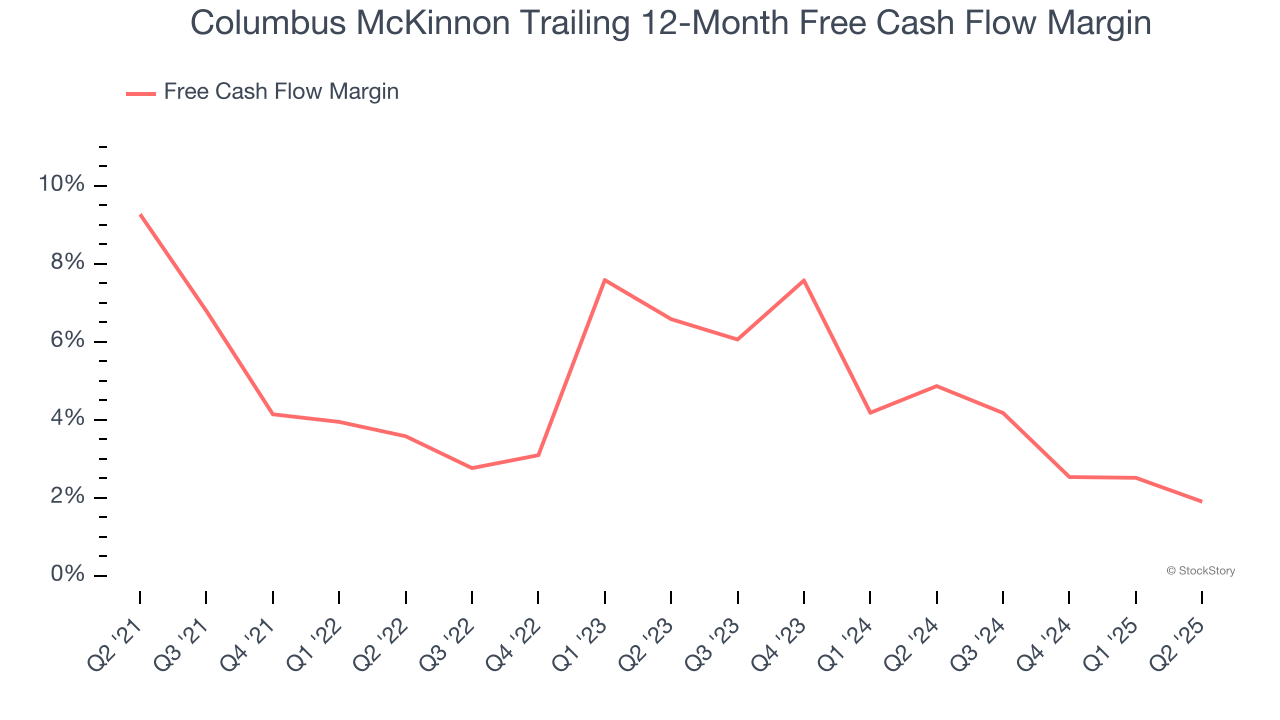

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Columbus McKinnon’s margin dropped by 7.4 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Columbus McKinnon’s free cash flow margin for the trailing 12 months was 1.9%.

Final Judgment

Columbus McKinnon falls short of our quality standards. After the recent drawdown, the stock trades at 5.5× forward P/E (or $14.91 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Columbus McKinnon

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.