Microsoft (MSFT)

433.50

-48.13 (-9.99%)

NASDAQ · Last Trade: Jan 29th, 7:49 PM EST

Detailed Quote

| Previous Close | 481.63 |

|---|---|

| Open | 439.99 |

| Bid | 433.80 |

| Ask | 433.81 |

| Day's Range | 421.02 - 442.50 |

| 52 Week Range | 344.79 - 555.45 |

| Volume | 129,014,759 |

| Market Cap | 3.27T |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 3.640 (0.84%) |

| 1 Month Average Volume | 30,097,306 |

Chart

About Microsoft (MSFT)

Microsoft is a leading global technology company known for its software products, services, and hardware devices. The company is best recognized for its Windows operating systems and the Microsoft Office suite, which facilitates productivity and collaboration for users worldwide. In addition to software, Microsoft also offers cloud computing services through its Azure platform, enabling businesses to leverage scalable and flexible computing resources. The company is actively involved in various sectors, including gaming with its Xbox platform, artificial intelligence, and cybersecurity, continually innovating and expanding its product offerings to meet the diverse needs of consumers and enterprises. Read More

News & Press Releases

Everus Construction Group delivers utility construction and specialty services across the Midwest and key urban markets.

Via The Motley Fool · January 29, 2026

This fintech firm delivers mobile-first, fee-free banking services targeting U.S. consumers seeking accessible financial solutions.

Via The Motley Fool · January 29, 2026

On Jan. 29, 2026, a rare post-earnings tumble in Microsoft rattled tech stocks even as the Dow hovered near records.

Via The Motley Fool · January 29, 2026

This global cruise operator leverages a multi-brand strategy to serve diverse leisure travelers across major international markets.

Via The Motley Fool · January 29, 2026

In a dramatic shift for global finance, the U.S. Dollar Index (DXY) has plummeted to its lowest level since early 2022, signaling an end to the "dollar exceptionalism" that defined the early 2020s. As of late January 2026, the greenback is trading in the 95.00–96.00 range,

Via MarketMinute · January 29, 2026

Today, Jan. 29, 2026, investors are weighing slowing cloud momentum against surging AI infrastructure spend at a software giant.

Via The Motley Fool · January 29, 2026

The benchmark 10-year Treasury yield has retreated to 4.25% as of January 29, 2026, offering a slight reprieve to a market that had been gripped by a sudden surge in borrowing costs earlier this month. The move marks a cooling from a five-month high of 4.31% reached on

Via MarketMinute · January 29, 2026

In a week dominated by shifting monetary policy signals, the United States labor market has once again proved its resilience. Data released this morning, January 29, 2026, by the Department of Labor revealed that initial jobless claims for the past week fell to 200,000, significantly lower than the consensus

Via MarketMinute · January 29, 2026

The stark divide in the financial markets reached a fever pitch today, January 29, 2026, as the long-anticipated "Great Rotation" finally appeared to take hold. While the tech-heavy Nasdaq Composite and the broader S&P 500 were dragged into the red by a staggering sell-off in artificial intelligence bellwethers, the

Via MarketMinute · January 29, 2026

The global software sector experienced one of its most turbulent trading sessions in recent history on January 29, 2026, as a wave of "sympathetic" selling swept through the industry’s heavyweights. The catalyst for the downturn was a cooling sentiment toward the artificial intelligence boom, sparked by a fiscal second-quarter

Via MarketMinute · January 29, 2026

In a sweeping move to combat a "lower-for-longer" earnings environment, Dow Inc. (NYSE: DOW) announced on January 29, 2026, a massive global restructuring initiative titled "Transform to Outperform." The plan includes the elimination of approximately 4,500 jobs—roughly 13% of the company’s global workforce—as the chemical giant

Via MarketMinute · January 29, 2026

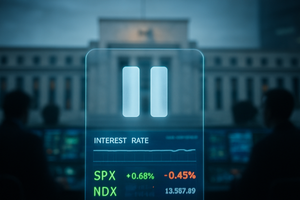

In a move that signaled a shift from aggressive easing to a strategic "wait-and-see" approach, the Federal Open Market Committee (FOMC) concluded its two-day policy meeting on January 28, 2026, by voting to maintain the federal funds rate at a target range of 3.50% to 3.75%. The decision

Via MarketMinute · January 29, 2026

The era of blind faith in Artificial Intelligence met a harsh reality on January 29, 2026, as Microsoft Corp. (NASDAQ:MSFT) saw its shares plummet by nearly 12%, erasing approximately $400 billion in market capitalization in a single trading session. The sell-off, the company's steepest one-day decline since the onset

Via MarketMinute · January 29, 2026

iPhone and iPad maker Apple (NASDAQ:AAPL) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 15.7% year on year to $143.8 billion. Its GAAP profit of $2.84 per share was 6.4% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Taiwan Semiconductor recently put up stellar fourth-quarter numbers, signaling that we've yet to reach peak AI demand. Are we in for another banner year in 2026?

Via The Motley Fool · January 29, 2026

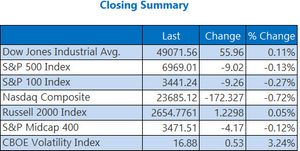

The S&P 500 settled lower on Thursday as Microsoft shares sold off amid slowing cloud growth and soft margin guidance, which triggered a triple-digit loss for the tech-heavy Nasdaq as software stocks struggled.

Via Talk Markets · January 29, 2026

The S&P 500 Index ($SPX ) (SPY ) on Thursday closed down -0.13%, the Dow Jones Industrials Index ($DOWI ) (DIA ) closed up +0.11%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) closed down -0.53%. March E-mini S&P futures (ESH26 ) fell -0.20%, an...

Via Barchart.com · January 29, 2026

The company mostly just found itself in the wrong place at the wrong time.

Via The Motley Fool · January 29, 2026

PATTAYA, THAILAND - January 29, 2026 - Digital marketing entrepreneur Tony Hayes has released a comprehensive free training series that's disrupting how small business owners and marketers approach app development. The 7-part video collection, titled "Is This the End of Hiring Developers? The Base44 Breakdown," provides step-by-step guidance for building monetizable apps without any coding knowledge.

Via AB Newswire · January 29, 2026

The cloud and database specialist got caught up in a broad AI sell-off.

Via The Motley Fool · January 29, 2026

The SaaS sector imploded today. Here's what you need to know.

Via The Motley Fool · January 29, 2026

Software stocks are having their worst month since 2008 aa analysts question whether AI will structurally suppress software demand.

Via Benzinga · January 29, 2026

Via MarketBeat · January 29, 2026

Shares of puerto Rican financial services company OFG Bancorp (NYSE:OFG) jumped 4.6% in the afternoon session after the company announced an increase in its quarterly dividend and a new $200 million stock repurchase plan.

Via StockStory · January 29, 2026

Shares of industrial process heating solutions provider Thermon (NYSE:THR) jumped 3.8% in the afternoon session after the company reported strong quarterly financial results that beat expectations. Thermon posted an adjusted earnings per share of $0.55, which was significantly higher than the forecast of $0.365. This result marked a positive earnings surprise of more than 50%. Additionally, the company's revenue came in at $131.7 million, surpassing the anticipated $119.95 million. These figures highlighted the company's solid performance during the recent quarter, leading to a positive reaction from investors.

Via StockStory · January 29, 2026